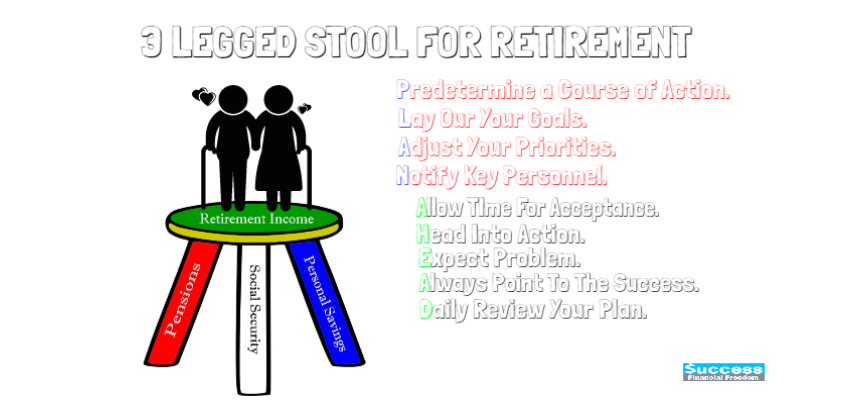

The three-legged stool is an investment terminology used for retirement. Many financial advisers use that to describe the three important sources of retirement income for retirees. -Social Security, employee pensions, and personal savings.

The structure of 3 legged Stool has changed dramatically last two decades. First of all, the pension plan which is known to be defined benefit retirement plan only offers 8 percent in private-sector and 16 percent of workers were participating in a pension plan at that time in 2013, compared to 2005, 21 percent of private-sector workers were enrolled. This is the significant change in the short period time and is expected to decline further. The reason behind is this, a pension plan is replacing the 401(K) plan in which employees fund most of their own retirement by automatically setting aside from each paycheck. Pensions plan have become more expensive for employers to provide and less spending money for employees’ benefits. Ironically, 401(k)’s were originally added to the IRS code as a way for companies to offer additional retirement benefits to high-ranking executives for the purpose of a match-up and a tax deduction for the corporation. Over time, most employers have made the shift from defined benefit pensions to 401(k)’s. The pension plan has many benefits to employees but the trend of retirement plan is becoming more 401(k) plan.

The second leg of the stool is social security, this has been a controversy to make elderly people worried over the benefits of retirement. Truthfully, it isn’t what people can rely on anymore. Although some people are still expecting to receive the benefits without knowing the amount. According to the 2008 annual report, the Social Security and Medicare Trustees estimate that the Social Security trust fund will run dry by 2041 if changes are not made to the system. You may not be able to access to the social security statement now because the government is concerned about the disclosure, however, the one I saw with my own eyes,2009 annual report, was unbelievable. It says social security funds would be exhausted by 2036. The matter of time that running out of social security funds start affecting us. We may not even sure whether we can receive what we have contributed out of every paycheck. For instance, I have been taught and currently working side by side with a multi-millionaire mentor. His name is John Shin, also a financial adviser. He personally showed me his own social security statement last year. This number was ridiculous. He lives in a house worth over 5 million dollars and pays over $100,000 for property tax every year. He has contributed over 40 years to social security but What he expected to get is less than $2,000. He won’t be able to keep the house, not even property tax. Some may say that he is rich and shouldn’t be getting even that much of benefit. However, his contribution is much higher than what he would receive. His personal savings is MUST.

The last leg that we want to count on is personal savings. 401(K)is also included in the personal savings, however, keeping 401(K)solely considering all the risk retirees may face to in retirement is not a good idea. IRA and 401(K) are 100% exposed to the market volatility and regulated by many rules to maintain money. In 2008 and 2009, People who were about to retire become desperate. In fact, they had to get a job back due to the loss of their money in 401(k), almost 50% of their money was wiped out. This could have avoided if they diversified their portfolio. If you don’t know what to do with diversification, make an hour to talk to a financial adviser to plan well for the future.

This video is taken in 2008. Find out about the truth about 401(K)

<Recommended Book>

The New Three-Legged Stool: A Tax Efficient Approach to Retirement Planning

One thought on “3 Legged Stool For Retirement”