Keeping your money in a safe place would give you at ease without a doubt. Have you ever wondered how safe it is to leave your money at a bank, which most people do? How about Bank of America, Chase, Fells Fargo, CitiBank and etc? What if the economy face to […]

Investment/Trade

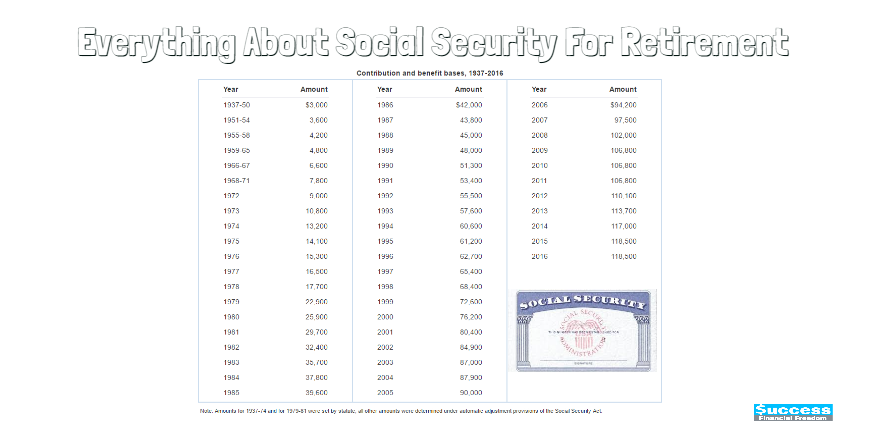

Everything About Social Security For Retirement

We pay for Social Security Benefits from every paycheck you work for. This is what government does and how they tax you from your paycheck. Please make sure to get Social Security Benefits as much as possible. 1. Social Security tax wage limit: $118,500 People pay 6.2% of their earnings […]

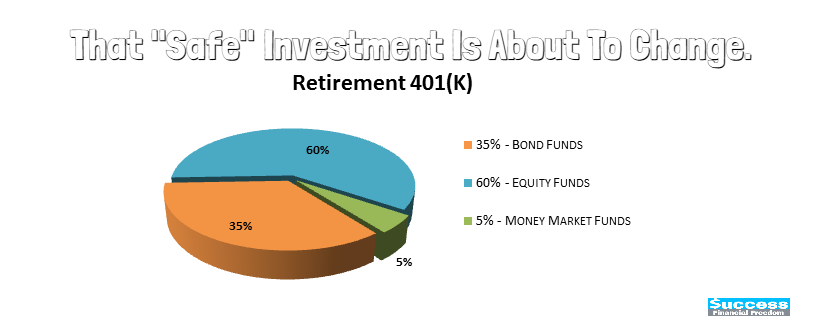

That “Safe” Investment Is About To Change.

If there is a flaw in your retirement investment, it has to change to come up with a solution. 401(K) has been known as “Safe” investment many participants can rely on for the income in their retirement. 401(K) has been managed in money-market funds and other funds and act as […]

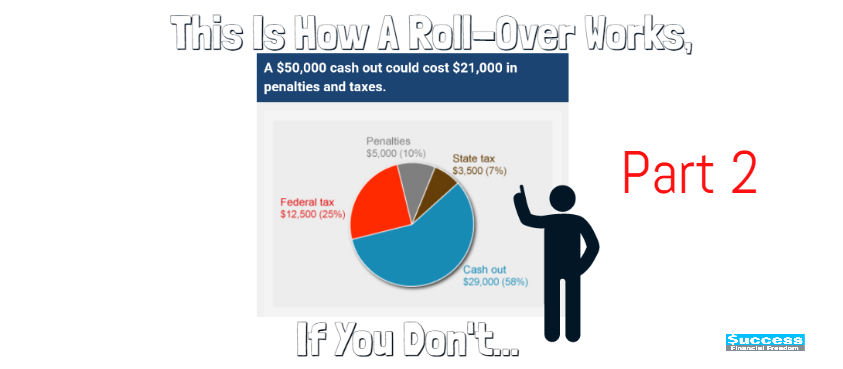

How A Roll-Over Works? 2

Here is the continuation of “How a roll –over works 1”, the previous blog talks about what a roll over is and what type of roll-over exists and also the options of 401(k) and 403(B)roll-over. It may not be easy to understand right away for beginners but identifying your retirement […]

How A Roll-Over Works? 1

Understanding how roll-over works and do a right roll-over separates you from financial literacy from financial illiteracy. If you are financial literacy, you will be able to make a good decision at the right timing to keep your money grow otherwise, you lose. Rolling over is a very critical thing […]

What Prevent You From Achieving Financial Freedom, Fear.

We offer people to build a business rather than keeping a job. This can be a big step in your life because you have to make something happened on your own with your own will. Being a business owner, you will receive so many benefits to making your life happy […]

What Is Qualified Retirement Plan? Is 401(K) a scam?

When you hear qualified investment plans, that sounds good and safe doesn’t it? Some people may keep a qualified retirement plan without knowing what they are and do. I want you to understand that any investment called “Qualified” means that it is a type of retirement plan established by an […]

Cash Flow Depends On Which Group You Belong To

Have you ever respected and/or listen to successful people from the bottom of your heart instead of having hatred and disrespect them? Have you ever wondered how they have gotten to the place where they are? No matter what they do regardless of how people think about them, they work […]

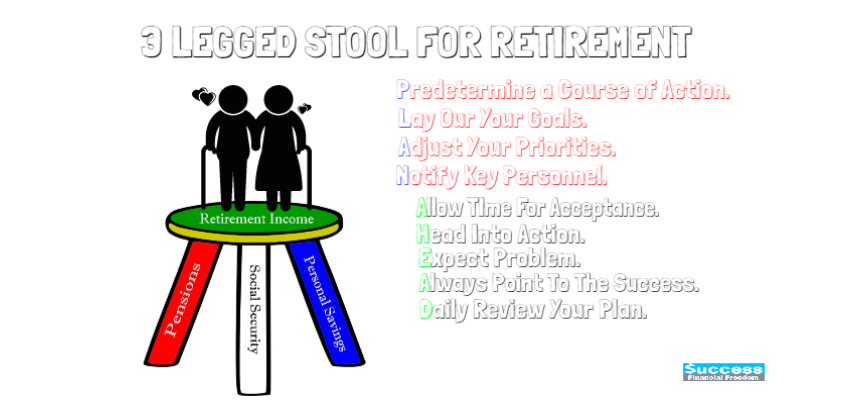

3 Legged Stool For Retirement

The three-legged stool is an investment terminology used for retirement. Many financial advisers use that to describe the three important sources of retirement income for retirees. -Social Security, employee pensions, and personal savings. The structure of 3 legged Stool has changed dramatically last two decades. First of all, the pension […]

Einstein’s Rule of 72

The rule of 72 is a simple equation created by Albert Einstein. He said that compounding interest is the eighth wonder of the world.It is the most powerful math equation. It is one of the simplest tools to help you calculate the estimate of accumulating wealth for how long it […]