The economy and market seem to be doing great. However, no major setback or bear market movement in the US market has occurred since 2009, although there have been some corrections, such as in 2011, 2015, 2020 (due to COVID-19), and 2022.

Behind the bubble, there is always something that creeps up on our economy to pop the bubble. The sign can be found if you look closer. The question is "What is the major concerning factor that could pop our economy? "One problem caught my attention: Failure of Signature Bank (2023)- this could be a canary in the coal mine.

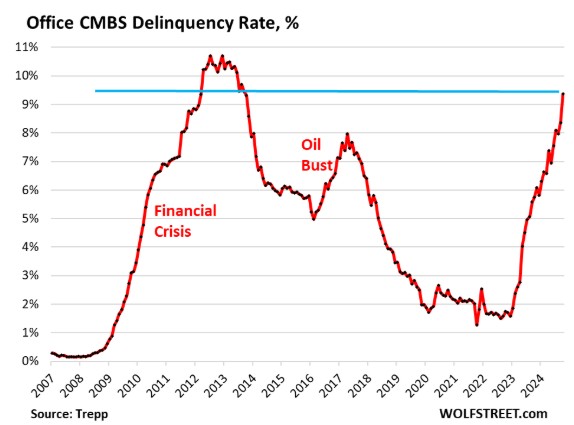

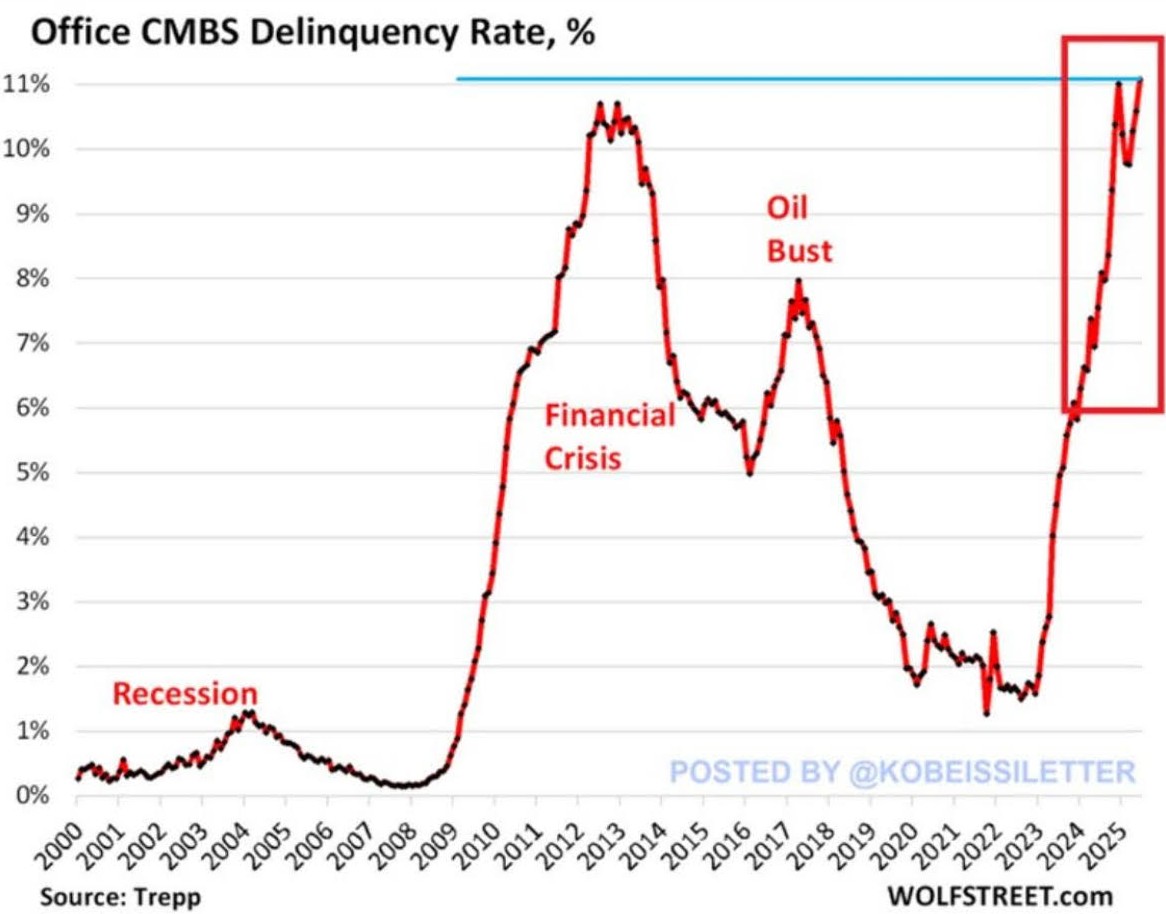

The CMBS Delinquency Rate has been climbing quietly and accelerating by 2.0% over the last 6 months. This may bring another crisis if the interest rate does not go down. Trump may be right on this.

Office CMBS Delinquency Rate Spikes to 9.4%, Highest Since Worst Months after the Financial Crisis

When a borrower fails to make timely payments on their mortgage, they may face delinquency on both the interest and the principal (the mortgage itself). Here’s what happens and the possible consequences:

1. Mortgage Delinquency Stages

-

1-15 Days Late: Usually no penalty, but late fees may apply after the grace period (often 15 days).

-

30 Days Late: Reported to credit bureaus, damaging credit score.

-

60 Days Late: Lender may issue a formal delinquency notice.

-

90 Days Late: Serious delinquency, lender may initiate foreclosure proceedings (depending on state laws).

-

120+ Days Late: Foreclosure process likely advances, leading to possible home seizure.

2. Consequences of Delinquency

-

Late Fees: Additional charges for missed payments.

-

Credit Score Damage: Delinquencies stay on credit reports for 7 years.

-

Default & Foreclosure Risk: If unresolved, the lender may demand full repayment or seize the property.

-

Legal Action: Possible lawsuit for deficiency judgment (if foreclosure sale doesn’t cover the debt).

3. Options to Avoid Foreclosure

-

Loan Modification: Adjusting terms (lower rate, extended term).

-

Forbearance Agreement: Temporary pause/reduction in payments.

-

Repayment Plan: Catch up on missed payments over time.

-

Short Sale: Sell home for less than owed (with lender approval).

-

Deed in Lieu of Foreclosure: Voluntarily transfer ownership to the lender.

4. Legal & Tax Implications

-

Tax on Forgiven Debt: If the lender forgives part of the loan (e.g., short sale), the IRS may treat it as taxable income (exceptions apply under certain programs).

-

Deficiency Judgment: Some states allow lenders to sue for the remaining balance after foreclosure.

5. How to Prevent Delinquency Contact Lender Early:

- Seek assistance before missing payments.

-

Budget Adjustments: Prioritize mortgage payments.

-

Government Programs: Explore options like FHA, VA, or HUD assistance.

Here’s what’s really happening and the potential consequences:

1. Why Office CMBS Delinquencies Are Spiking

A. Remote/Hybrid Work Killing Demand

-

Companies are downsizing office space as remote work becomes permanent.

-

Vacancy rates in major cities (e.g., San Francisco, NYC) are at record highs (over 20%+ in some markets).

-

Landlords can’t fill space → rental income drops → cash flow problems → loan defaults.

B. Refinancing Crisis (Due to Higher Interest Rates)

-

Many office loans were taken at low pre-2022 rates and are now maturing.

-

Refinancing is much more expensive (if available at all), leading to loan defaults.

-

Banks and lenders are reluctant to extend credit, fearing further losses.

C. Falling Property Values

-

Office building values have plunged 30-50% in some markets.

-

Borrowers owe more than the property is worth ("underwater" loans).

-

Many choose strategic defaults (walking away) rather than throwing good money after bad.

2. Consequences of Rising CMBS Delinquencies

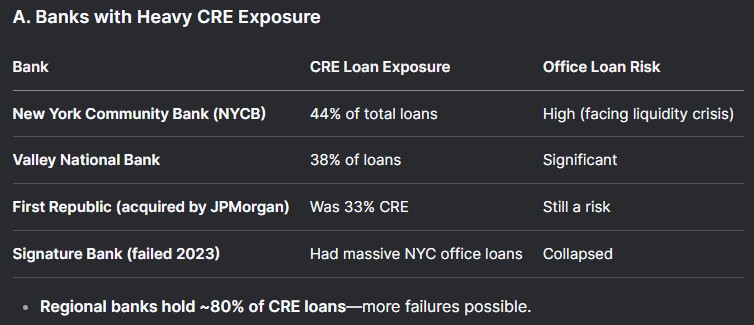

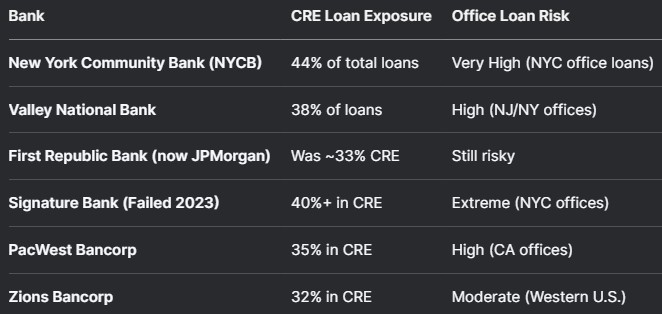

A. Banks & Lenders Take Heavy Losses

-

CMBS investors (pension funds, insurers, REITs) face steep losses.

-

Regional banks (with heavy CRE exposure) could see more failures (like Silicon Valley Bank fallout).

B. Commercial Real Estate (CRE) Market Collapse

-

More distressed sales (fire sales of office buildings).

-

Developers halt new projects, worsening urban economic activity.

C. Municipal Budget Crises

-

Cities rely on property taxes from offices; values drop → tax revenue falls.

-

Local governments may cut services or raise taxes elsewhere.

D. Contagion Risk to Broader Economy

-

If banks tighten lending further, small businesses and other real estate sectors (retail, multifamily) could suffer.

-

Job losses in construction, property management, and related sectors.

3. What Happens Next?

-

More Loan Defaults: As more loans mature, delinquencies will keep rising.

-

Bankruptcies & Restructurings: Many office landlords may file Chapter 11 or negotiate loan extensions.

-

Government Intervention? Possible bailouts for banks or incentives to convert offices to residential (but this is costly and slow).

The office sector is in a doom loop:

Less demand → Lower rents → Loan defaults → Bank losses → Less lending → More distress.

This won’t be another 2008-style meltdown (since residential markets are stronger), but it will hurt investors, banks, and cities for years.

Which Banks & Investors Are Exposed?